News: #MrRobot, #JessicaJones And #CrazyExGirlfriend Win First #Emmys.https://t.co/Bo0l3GHVkQ via @deadline

— AccademiaTelefilm (@AcademyTelefilm) 11 settembre 2016

Visualizzazione post con etichetta Crazy ex Girlfriend. Mostra tutti i post

Visualizzazione post con etichetta Crazy ex Girlfriend. Mostra tutti i post

lunedì 12 settembre 2016

martedì 21 giugno 2016

NEWS - Clamoroso al Cibali! Accordo epocale tra Netflix e CW per trasmettere i titoli del secondo meno di due settimane dopo la fine sul network!

News tratta da "Variety"

Netflix and the CW

are close to finalizing a megabucks new deal covering scripted series

that significantly speeds up the availability of the shows to less than

two weeks after each season ends on the network.

Netflix and the CW

are close to finalizing a megabucks new deal covering scripted series

that significantly speeds up the availability of the shows to less than

two weeks after each season ends on the network.

The expanded pact with Netflix comes as CW and Hulu are parting ways on the deal that made selected current episodes of CW series available for streaming on a rolling-five basis. CW first set its streaming deals with Netflix and Hulu in 2011. Those deals were crucial to shoring up the future of CW five years ago, and now the expanded Netflix pact is a testament to the network’s improved performance.

With the Hulu deal ending, in-season streaming access to CW series will flow through the advertising-supported CWTV.com website and app as well as its affiliate stations’ VOD deals with various MVPD providers. In-season access will remain limited to a rolling-five most recent episodes, in most cases.

Reps for CW, Hulu and Netflix declined comment. The CW-Netflix deal is expected to be unveiled later this week.

The limited access to episodes was the big sticking point for Hulu, which is said to have pushed CW to offer full stacking rights on its Hulu service as a condition of renewing the deal. Hulu and CW parent companies CBS and Warner Bros. negotiated on and off for months but late last week the sides formally ended the discussions. The existing deal is believed to expire in early October.

Netflix, meanwhile, has stepped up the financial terms of its output deal in order to speed up the arrival of the shows on the SVOD giant. Previously, CW series came to Netflix after a months-long wait, usually timed to land a week or two before the start of a new season for continuing series.

The total pricetag of the deal is tricky to estimate for Netflix because it involves so many shows and variables such as escalators that kick in depending on how long a series has been on the air and how it performs. But it is sure to rank as one of the largest output deals in the SVOD arena to date with value that could exceed $1 billion. The deal is believed to run five years, with a tail that gives Netflix access to the CW library for several years after each series ends its run on the network. The deal covers domestic rights to the shows, not the vast expanse of Netflix’s worldwide footprint.

The deal also marks the closest window Netflix has ever secured to the in-season period for primetime entertainment series, and less than a year after CEOs of several media conglomerates publicly indicated they were going to toughen their licensing strategies with subscription VOD services that were arguably cannibalizing linear ratings. “We are evaluating whether to retain our rights for a longer period of time and forego or delay certain content licensing,” Time Warner CEO Jeff Bewkes told investors on an earnings call last November.

That said, the CW-Netflix pact may end up an outlier to an otherwise increasingly conservative next wave of licensing deals between streaming services and conglomerates, many of whom are focusing more on their own streaming extensions.

CBS Corp. and Warner Bros., which produce the vast majority of CW’s primetime series, led the negotiations. The CW’s studio partners came back to the table this time around with a stronger hand compared to five years ago, thanks to CW’s growth under president Mark Pedowitz. Netflix’s willingness to step up for earlier post-season access to the shows reflects the sizzle CW has generated with its fleet of DC Comics-branded superhero shows, notably “The Flash” and “Arrow,” and buzzy critical darlings “Jane the Virgin” and “Crazy Ex-Girlfriend.”

From Hulu’s perspective, however, the CW in-season rights were not worth the pricetag to renew unless it came with stacking rights to all episodes — something that surely would have been a non-starter for CW and Netflix. From Hulu’s perspective, sources said, the vast majority of viewing was delivered only by CW’s two highest-rated shows: “The Flash” and “Arrow.” Moreover, fans of those two shows frequently lodge complaints with Hulu about the limited five-episode selection.

With Hulu bowing out, CW now has a stronger pitch to make to its broadcast affiliates about maintaining exclusivity of access to in-season streaming rights. The hope is that the tightened availability will boost streaming viewership via the CW’s website, which in turn could bring in more advertising revenue.

CW’s move to finalize the course for its streaming distribution for the next few years comes weeks after the network finalized a new five-year affiliation pact with its core Tribune Broadcasting station group.

Hulu’s strategic focus remains on being the hub for next-day access to current series from its partner networks Fox, NBC and ABC, in addition to its output pacts with FX and AMC Networks, Epix movie deal and off-network acquisitions including the “Seinfeld” library.

Hulu is also in the midst of a push to become a virtual MVPD by offering a skinny bundle of channels via OTT distribution.

News tratta da "Variety"

Netflix and the CW

are close to finalizing a megabucks new deal covering scripted series

that significantly speeds up the availability of the shows to less than

two weeks after each season ends on the network.

Netflix and the CW

are close to finalizing a megabucks new deal covering scripted series

that significantly speeds up the availability of the shows to less than

two weeks after each season ends on the network.The expanded pact with Netflix comes as CW and Hulu are parting ways on the deal that made selected current episodes of CW series available for streaming on a rolling-five basis. CW first set its streaming deals with Netflix and Hulu in 2011. Those deals were crucial to shoring up the future of CW five years ago, and now the expanded Netflix pact is a testament to the network’s improved performance.

With the Hulu deal ending, in-season streaming access to CW series will flow through the advertising-supported CWTV.com website and app as well as its affiliate stations’ VOD deals with various MVPD providers. In-season access will remain limited to a rolling-five most recent episodes, in most cases.

Reps for CW, Hulu and Netflix declined comment. The CW-Netflix deal is expected to be unveiled later this week.

The limited access to episodes was the big sticking point for Hulu, which is said to have pushed CW to offer full stacking rights on its Hulu service as a condition of renewing the deal. Hulu and CW parent companies CBS and Warner Bros. negotiated on and off for months but late last week the sides formally ended the discussions. The existing deal is believed to expire in early October.

Netflix, meanwhile, has stepped up the financial terms of its output deal in order to speed up the arrival of the shows on the SVOD giant. Previously, CW series came to Netflix after a months-long wait, usually timed to land a week or two before the start of a new season for continuing series.

The total pricetag of the deal is tricky to estimate for Netflix because it involves so many shows and variables such as escalators that kick in depending on how long a series has been on the air and how it performs. But it is sure to rank as one of the largest output deals in the SVOD arena to date with value that could exceed $1 billion. The deal is believed to run five years, with a tail that gives Netflix access to the CW library for several years after each series ends its run on the network. The deal covers domestic rights to the shows, not the vast expanse of Netflix’s worldwide footprint.

The deal also marks the closest window Netflix has ever secured to the in-season period for primetime entertainment series, and less than a year after CEOs of several media conglomerates publicly indicated they were going to toughen their licensing strategies with subscription VOD services that were arguably cannibalizing linear ratings. “We are evaluating whether to retain our rights for a longer period of time and forego or delay certain content licensing,” Time Warner CEO Jeff Bewkes told investors on an earnings call last November.

That said, the CW-Netflix pact may end up an outlier to an otherwise increasingly conservative next wave of licensing deals between streaming services and conglomerates, many of whom are focusing more on their own streaming extensions.

CBS Corp. and Warner Bros., which produce the vast majority of CW’s primetime series, led the negotiations. The CW’s studio partners came back to the table this time around with a stronger hand compared to five years ago, thanks to CW’s growth under president Mark Pedowitz. Netflix’s willingness to step up for earlier post-season access to the shows reflects the sizzle CW has generated with its fleet of DC Comics-branded superhero shows, notably “The Flash” and “Arrow,” and buzzy critical darlings “Jane the Virgin” and “Crazy Ex-Girlfriend.”

From Hulu’s perspective, however, the CW in-season rights were not worth the pricetag to renew unless it came with stacking rights to all episodes — something that surely would have been a non-starter for CW and Netflix. From Hulu’s perspective, sources said, the vast majority of viewing was delivered only by CW’s two highest-rated shows: “The Flash” and “Arrow.” Moreover, fans of those two shows frequently lodge complaints with Hulu about the limited five-episode selection.

With Hulu bowing out, CW now has a stronger pitch to make to its broadcast affiliates about maintaining exclusivity of access to in-season streaming rights. The hope is that the tightened availability will boost streaming viewership via the CW’s website, which in turn could bring in more advertising revenue.

CW’s move to finalize the course for its streaming distribution for the next few years comes weeks after the network finalized a new five-year affiliation pact with its core Tribune Broadcasting station group.

Hulu’s strategic focus remains on being the hub for next-day access to current series from its partner networks Fox, NBC and ABC, in addition to its output pacts with FX and AMC Networks, Epix movie deal and off-network acquisitions including the “Seinfeld” library.

Hulu is also in the midst of a push to become a virtual MVPD by offering a skinny bundle of channels via OTT distribution.

Iscriviti a:

Post (Atom)

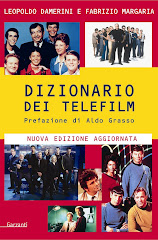

"Il trivial game + divertente dell'anno" (Lucca Comics)

Il GIOCO DEI TELEFILM di Leopoldo Damerini e Fabrizio Margaria, nei migliori negozi di giocattoli: un viaggio lungo 750 domande divise per epoche e difficoltà. Sfida i tuoi amici/parenti/partner/amanti e diventa Telefilm Master. Disegni originali by Silver. Regolamento di Luca Borsa. E' un gioco Ghenos Games. http://www.facebook.com/GiocoDeiTelefilm. https://twitter.com/GiocoTelefilm

Lick it or Leave it!

.jpg)